Depreciation On The Office Equipment For The Year Is $10 500 . for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. Enter the asset value, percentage and. calculate the depreciation of an asset by an annual percentage using this online tool. calculate depreciation expense and accumulated depreciation using three methods: learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. See the formula, steps, example.

from www.chegg.com

Enter the asset value, percentage and. See the formula, steps, example. for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. calculate the depreciation of an asset by an annual percentage using this online tool. calculate depreciation expense and accumulated depreciation using three methods: learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life.

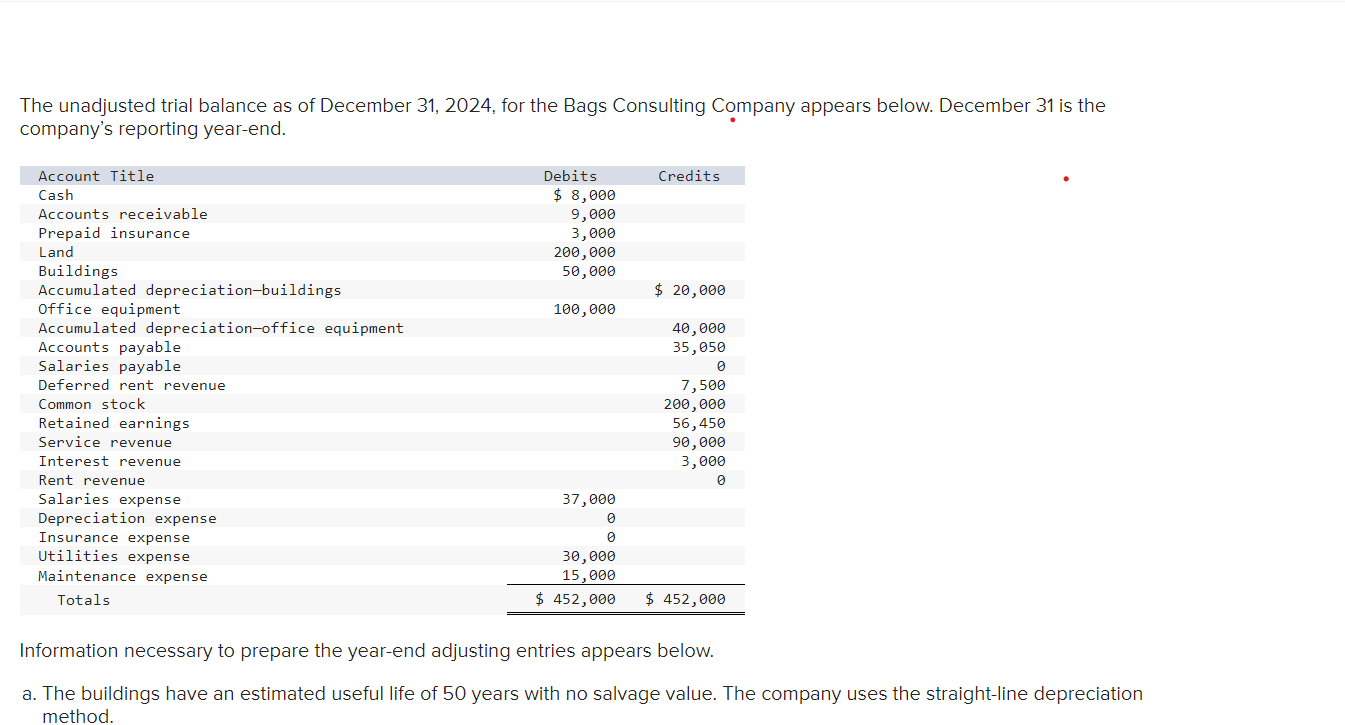

Solved b. The office equipment is depreciated at 10 percent

Depreciation On The Office Equipment For The Year Is $10 500 calculate depreciation expense and accumulated depreciation using three methods: calculate the depreciation of an asset by an annual percentage using this online tool. calculate depreciation expense and accumulated depreciation using three methods: for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. See the formula, steps, example. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. Enter the asset value, percentage and.

From haipernews.com

How To Calculate Depreciation For Building Haiper Depreciation On The Office Equipment For The Year Is $10 500 calculate the depreciation of an asset by an annual percentage using this online tool. for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. Enter the asset value, percentage and. See the formula, steps, example. calculate depreciation expense and accumulated depreciation using three methods: learn how to calculate. Depreciation On The Office Equipment For The Year Is $10 500.

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy Depreciation On The Office Equipment For The Year Is $10 500 calculate the depreciation of an asset by an annual percentage using this online tool. Enter the asset value, percentage and. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. calculate depreciation expense and accumulated depreciation using three methods: for example, if you depreciate. Depreciation On The Office Equipment For The Year Is $10 500.

From www.sampleschedule.com

27+ Sample Depreciation Schedule sample schedule Depreciation On The Office Equipment For The Year Is $10 500 calculate depreciation expense and accumulated depreciation using three methods: See the formula, steps, example. for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. Enter the asset value, percentage and. calculate the depreciation of an asset by an annual percentage using this online tool. learn how to calculate. Depreciation On The Office Equipment For The Year Is $10 500.

From www.chegg.com

Solved a. Depreciation on the company's equipment for the Depreciation On The Office Equipment For The Year Is $10 500 learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. calculate the depreciation of an asset by an annual percentage using this online tool. for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. Enter the asset. Depreciation On The Office Equipment For The Year Is $10 500.

From www.chegg.com

Solved Please prepare Accumulated depreciation of office Depreciation On The Office Equipment For The Year Is $10 500 calculate the depreciation of an asset by an annual percentage using this online tool. See the formula, steps, example. Enter the asset value, percentage and. calculate depreciation expense and accumulated depreciation using three methods: learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. . Depreciation On The Office Equipment For The Year Is $10 500.

From www.chegg.com

Solved a. Depreciation on the company's equipment for the Depreciation On The Office Equipment For The Year Is $10 500 calculate the depreciation of an asset by an annual percentage using this online tool. See the formula, steps, example. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. calculate depreciation expense and accumulated depreciation using three methods: for example, if you depreciate that. Depreciation On The Office Equipment For The Year Is $10 500.

From answerhappy.com

Journal entry worksheet Depreciation On The Office Equipment For The Year Is $10 500 calculate the depreciation of an asset by an annual percentage using this online tool. Enter the asset value, percentage and. calculate depreciation expense and accumulated depreciation using three methods: See the formula, steps, example. for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. learn how to calculate. Depreciation On The Office Equipment For The Year Is $10 500.

From www.chegg.com

Solved a. Depreciation on the company's equipment for the Depreciation On The Office Equipment For The Year Is $10 500 for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. See the formula, steps, example. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. calculate the depreciation of an asset by an annual percentage using this. Depreciation On The Office Equipment For The Year Is $10 500.

From www.youtube.com

How to prepare depreciation schedule in excel YouTube Depreciation On The Office Equipment For The Year Is $10 500 Enter the asset value, percentage and. calculate depreciation expense and accumulated depreciation using three methods: for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. See the formula, steps, example. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by. Depreciation On The Office Equipment For The Year Is $10 500.

From www.babelsoftco.com

Equipment Depreciation Report Babelsoftco Depreciation On The Office Equipment For The Year Is $10 500 calculate depreciation expense and accumulated depreciation using three methods: Enter the asset value, percentage and. See the formula, steps, example. calculate the depreciation of an asset by an annual percentage using this online tool. for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. learn how to calculate. Depreciation On The Office Equipment For The Year Is $10 500.

From dxoaerbpc.blob.core.windows.net

Standard Depreciation Rate For Office Equipment at Peggy Nisbet blog Depreciation On The Office Equipment For The Year Is $10 500 for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. Enter the asset value, percentage and. See the formula, steps, example. calculate the depreciation of an asset. Depreciation On The Office Equipment For The Year Is $10 500.

From businessyield.com

DEPRECIATION ACCOUNTING Definition, Methods, Formula & All you should Depreciation On The Office Equipment For The Year Is $10 500 calculate depreciation expense and accumulated depreciation using three methods: learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. Enter the asset value, percentage and. calculate. Depreciation On The Office Equipment For The Year Is $10 500.

From www.slideserve.com

PPT LESSON 161 PowerPoint Presentation, free download ID5762509 Depreciation On The Office Equipment For The Year Is $10 500 calculate the depreciation of an asset by an annual percentage using this online tool. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. calculate depreciation expense and accumulated depreciation using three methods: for example, if you depreciate that $10,000 piece of equipment over. Depreciation On The Office Equipment For The Year Is $10 500.

From www.superfastcpa.com

What is Accumulated Depreciation Equipment? Depreciation On The Office Equipment For The Year Is $10 500 for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. calculate the depreciation of an asset by an annual percentage using this online tool. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. calculate depreciation. Depreciation On The Office Equipment For The Year Is $10 500.

From www.scribd.com

Depreciation table PPE.xlsx Equipment Consumer Goods Depreciation On The Office Equipment For The Year Is $10 500 calculate depreciation expense and accumulated depreciation using three methods: calculate the depreciation of an asset by an annual percentage using this online tool. See the formula, steps, example. Enter the asset value, percentage and. learn how to calculate straight line depreciation of an asset's value by dividing the cost less salvage value by the useful life. . Depreciation On The Office Equipment For The Year Is $10 500.

From www.chegg.com

Solved b. The office equipment is depreciated at 10 percent Depreciation On The Office Equipment For The Year Is $10 500 calculate depreciation expense and accumulated depreciation using three methods: for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. calculate the depreciation of an asset by an annual percentage using this online tool. learn how to calculate straight line depreciation of an asset's value by dividing the cost. Depreciation On The Office Equipment For The Year Is $10 500.

From exobehtve.blob.core.windows.net

The Journal Entry To Record Depreciation Expense For A Piece Of Depreciation On The Office Equipment For The Year Is $10 500 for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. calculate the depreciation of an asset by an annual percentage using this online tool. Enter the asset value, percentage and. calculate depreciation expense and accumulated depreciation using three methods: See the formula, steps, example. learn how to calculate. Depreciation On The Office Equipment For The Year Is $10 500.

From old.sermitsiaq.ag

Depreciation Schedule Excel Template Depreciation On The Office Equipment For The Year Is $10 500 Enter the asset value, percentage and. calculate the depreciation of an asset by an annual percentage using this online tool. calculate depreciation expense and accumulated depreciation using three methods: See the formula, steps, example. for example, if you depreciate that $10,000 piece of equipment over 10 years, you’ll record a $1,000 depreciation. learn how to calculate. Depreciation On The Office Equipment For The Year Is $10 500.